TX Form 22.15 - Harris County 2014-2024 free printable template

Show details

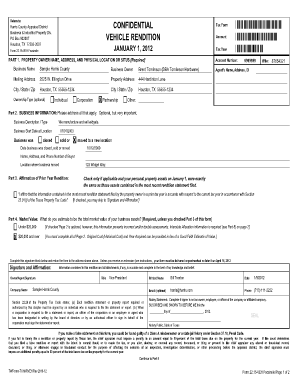

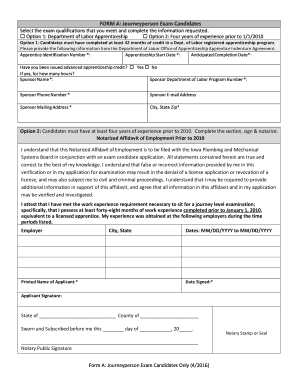

Hcad.org/forms/ Form 22. 15 12/13 Part 1. Property Owner Name Address and Physical Location or Situs Required Account Number Business Name Business Owner iFile Number Mail Address Agent s Name Agent ID No. City/State/Zip Part 2. Return to Harris County Appraisal District Business Industrial Property Div. PO Box 922007 Houston TX 77292-2007 NEWPP130 CONFIDENTIAL - BUSINESS PERSONAL PROPERTY RENDITION January 1 2014 For assistance with this form please refer to instructions 22-15-INS at www....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form rendition 2014-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form rendition 2014-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form rendition online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas form 22 15. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

TX Form 22.15 - Harris County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form rendition 2014-2024

How to fill out Texas form 22 15:

01

First, obtain a copy of Texas form 22 15 from the appropriate source.

02

Carefully read through the instructions provided with the form to ensure you understand all the requirements and information needed.

03

Begin by filling out the personal information section at the top of the form, including your name, address, and contact details.

04

Follow the prompts to provide any additional required information, such as your social security number or tax identification number.

05

Fill in the specific details requested in each section of the form, such as your income, deductions, and credits. Make sure to double check your entries for accuracy.

06

If you are unsure about any part of the form, seek clarification from a tax professional or refer to the provided instructions.

07

Review your completed form for any errors or omissions before submitting it.

08

Sign and date the form as required.

09

Keep a copy of the completed form for your records.

Who needs Texas form 22 15:

01

Texas form 22 15 is typically needed by individuals who are required to file a state income tax return in Texas.

02

This form may be necessary for residents and non-residents who have earned income in Texas and meet the filing requirements of the state.

03

It is important to determine if you need to file this form based on your specific circumstances, such as your income level and residency status.

Video instructions and help with filling out and completing form rendition

Instructions and Help about form 22 15 property rendition

Fill harris county form 22 15 : Try Risk Free

People Also Ask about form rendition

How much is business personal property tax in Texas?

What is property tax rendition Texas?

What is the rendition penalty in Harris County?

What is property code CH 22 in Texas?

What is the Texas property tax code?

What is property code 22.01 in Texas?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas form 22 15?

Texas Form 22-15 is a document used by the Texas Comptroller of Public Accounts to report the estimated taxes for individuals who are engaged in business activities, such as individuals who are self-employed or running a business. The form is used to calculate and report the amount of estimated tax liability due to the state of Texas.

Who is required to file texas form 22 15?

Texas Form 22-15 is required to be filed by any business operating in Texas that has employees who are subject to federal income tax withholding and/or Texas unemployment tax. This includes both for-profit and nonprofit organizations.

How to fill out texas form 22 15?

Form 22-15 is a Texas Comptroller of Public Accounts form used for the purpose of filing a sales and use tax return. It is required for businesses that are registered to collect and remit sales and use tax in Texas.

The form is fairly straightforward and can be filled out using an online form-filler. Generally, the information required includes your business's name, address, contact information, and Federal Employer Identification Number (FEIN). You will also need to provide your sales and use tax account number, as well as your total taxable sales and use tax due. Additionally, you will need to report the total amount of sales tax collected during the reporting period, and the total amount of use tax due.

Once all of the required information is filled out, you can submit your Form 22-15 online or mail it to the Texas Comptroller of Public Accounts.

What is the purpose of texas form 22 15?

Texas Form 22-15 is the Texas Franchise Tax Report, which is used by taxpayers to report their franchise tax to the state of Texas. This form is required to be filed by all businesses registered in Texas.

What information must be reported on texas form 22 15?

Texas Form 22-15 is a report of the net amount of taxable wages and tips paid in a calendar quarter to employees who are subject to Texas unemployment tax. The form must include the name of the employee, their Social Security Number, the amount of taxable wages and tips paid in the quarter, and the employer's Federal Identification Number.

When is the deadline to file texas form 22 15 in 2023?

The deadline to file Texas Form 22-15 in 2023 is April 15, 2023.

What is the penalty for the late filing of texas form 22 15?

The penalty for the late filing of Texas Form 22-15 is 5% of the amount due, with a minimum of $50 and a maximum of 25% of the amount due.

Can I create an eSignature for the form rendition in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your texas form 22 15 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit tx form business rendition on an iOS device?

You certainly can. You can quickly edit, distribute, and sign harris county appraisal district 22 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I fill out harris county appraisal district 22 15 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form 22 15. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your form rendition 2014-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tx Form Business Rendition is not the form you're looking for?Search for another form here.

Keywords relevant to how to form rendition

Related to form business personal rendition

If you believe that this page should be taken down, please follow our DMCA take down process

here

.